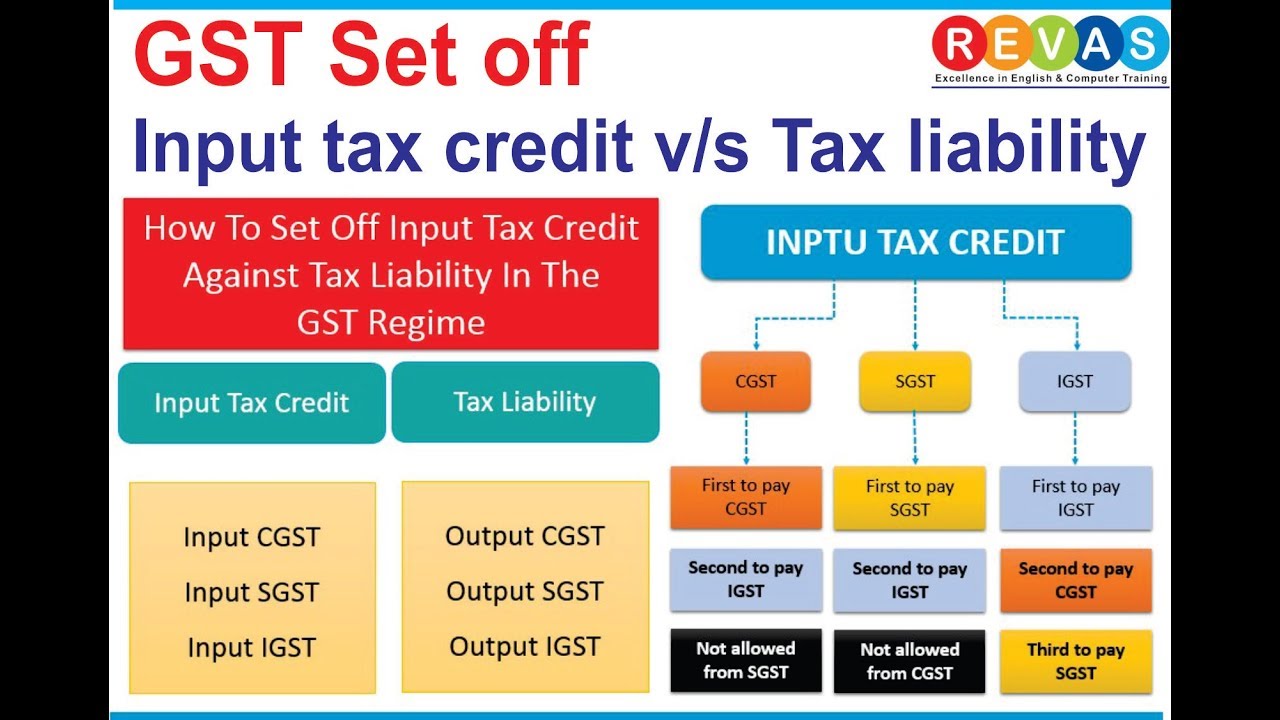

Itc Available On Security Services Under Gst . Registered persons who pay gst under rcm for security services are eligible. gst was applicable on security services w.e.f. gst on security services was applicable from 1 st of july 2017 on forward charge but it has been brought under. security service is a service wherein a person supplies security personnel to another person for a consideration. input tax credit (itc) under rcm for security services: input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. the article explains how the input tax credit mechanism works under gst, recent updates, claiming procedures, and type of taxes under gst. However with effect from 01.01.2019 any registered person receiving security services (service. 01/07/2017 under forward charge mechanism. But considering the numerous problems in.

from lorrosongoo.blogspot.com

gst was applicable on security services w.e.f. 01/07/2017 under forward charge mechanism. input tax credit (itc) under rcm for security services: gst on security services was applicable from 1 st of july 2017 on forward charge but it has been brought under. security service is a service wherein a person supplies security personnel to another person for a consideration. Registered persons who pay gst under rcm for security services are eligible. However with effect from 01.01.2019 any registered person receiving security services (service. the article explains how the input tax credit mechanism works under gst, recent updates, claiming procedures, and type of taxes under gst. But considering the numerous problems in. input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business.

Gst Input And Output GSTInput Tax Credit under Revised model GST Law

Itc Available On Security Services Under Gst gst was applicable on security services w.e.f. However with effect from 01.01.2019 any registered person receiving security services (service. input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. But considering the numerous problems in. security service is a service wherein a person supplies security personnel to another person for a consideration. gst on security services was applicable from 1 st of july 2017 on forward charge but it has been brought under. 01/07/2017 under forward charge mechanism. input tax credit (itc) under rcm for security services: Registered persons who pay gst under rcm for security services are eligible. the article explains how the input tax credit mechanism works under gst, recent updates, claiming procedures, and type of taxes under gst. gst was applicable on security services w.e.f.

From arpanbohra.co.in

RCM on Security Services under GST Arpan Bohra & Co Itc Available On Security Services Under Gst the article explains how the input tax credit mechanism works under gst, recent updates, claiming procedures, and type of taxes under gst. gst on security services was applicable from 1 st of july 2017 on forward charge but it has been brought under. gst was applicable on security services w.e.f. input tax credit (itc) in gst. Itc Available On Security Services Under Gst.

From www.indiafilings.com

SAC Code and GST on Security Services Itc Available On Security Services Under Gst input tax credit (itc) under rcm for security services: Registered persons who pay gst under rcm for security services are eligible. 01/07/2017 under forward charge mechanism. security service is a service wherein a person supplies security personnel to another person for a consideration. the article explains how the input tax credit mechanism works under gst, recent updates,. Itc Available On Security Services Under Gst.

From arpanbohra.co.in

RCM on Security Services under GST Arpan Bohra & Co Itc Available On Security Services Under Gst gst on security services was applicable from 1 st of july 2017 on forward charge but it has been brought under. security service is a service wherein a person supplies security personnel to another person for a consideration. input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. However. Itc Available On Security Services Under Gst.

From blog.saginfotech.com

Claim GST ITC on Goods/Services While Working for Renewable Power Itc Available On Security Services Under Gst input tax credit (itc) under rcm for security services: Registered persons who pay gst under rcm for security services are eligible. gst was applicable on security services w.e.f. input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. 01/07/2017 under forward charge mechanism. gst on security services was. Itc Available On Security Services Under Gst.

From www.youtube.com

GST RCM, SERVICES UNDER GST RCM (GTA, LEGAL, SECURITY, SPONSORSHIP Itc Available On Security Services Under Gst But considering the numerous problems in. Registered persons who pay gst under rcm for security services are eligible. 01/07/2017 under forward charge mechanism. gst was applicable on security services w.e.f. input tax credit (itc) under rcm for security services: However with effect from 01.01.2019 any registered person receiving security services (service. the article explains how the input. Itc Available On Security Services Under Gst.

From www.pinterest.pt

Detail article on GTA Services under GST provisions. Definition of GTA Itc Available On Security Services Under Gst input tax credit (itc) under rcm for security services: security service is a service wherein a person supplies security personnel to another person for a consideration. input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. 01/07/2017 under forward charge mechanism. gst on security services was applicable from. Itc Available On Security Services Under Gst.

From lorrosongoo.blogspot.com

Gst Input And Output GSTInput Tax Credit under Revised model GST Law Itc Available On Security Services Under Gst But considering the numerous problems in. 01/07/2017 under forward charge mechanism. input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. security service is a service wherein a person supplies security personnel to another person for a consideration. the article explains how the input tax credit mechanism works under. Itc Available On Security Services Under Gst.

From www.gstclub.in

Home Itc Available On Security Services Under Gst input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. gst was applicable on security services w.e.f. Registered persons who pay gst under rcm for security services are eligible. security service is a service wherein a person supplies security personnel to another person for a consideration. But considering the. Itc Available On Security Services Under Gst.

From carajput.com

whether itc available on canteen services, itc on canteen services Itc Available On Security Services Under Gst gst was applicable on security services w.e.f. input tax credit (itc) under rcm for security services: gst on security services was applicable from 1 st of july 2017 on forward charge but it has been brought under. security service is a service wherein a person supplies security personnel to another person for a consideration. 01/07/2017 under. Itc Available On Security Services Under Gst.

From www.youtube.com

SECURITY SERVICES UNDER GST BY MOHD RAFI YouTube Itc Available On Security Services Under Gst gst was applicable on security services w.e.f. input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. 01/07/2017 under forward charge mechanism. gst on security services was applicable from 1 st of july 2017 on forward charge but it has been brought under. security service is a service. Itc Available On Security Services Under Gst.

From www.consultease.com

What is RCM in GST, Who is covered & penalty Itc Available On Security Services Under Gst 01/07/2017 under forward charge mechanism. But considering the numerous problems in. However with effect from 01.01.2019 any registered person receiving security services (service. input tax credit (itc) under rcm for security services: security service is a service wherein a person supplies security personnel to another person for a consideration. gst was applicable on security services w.e.f. . Itc Available On Security Services Under Gst.

From www.consultease.com

What is RCM in GST, Who is covered & penalty Itc Available On Security Services Under Gst security service is a service wherein a person supplies security personnel to another person for a consideration. 01/07/2017 under forward charge mechanism. However with effect from 01.01.2019 any registered person receiving security services (service. gst on security services was applicable from 1 st of july 2017 on forward charge but it has been brought under. But considering the. Itc Available On Security Services Under Gst.

From cleartax.in

ITC02A Form under GST Applicability and Procedure to file on GST Portal Itc Available On Security Services Under Gst the article explains how the input tax credit mechanism works under gst, recent updates, claiming procedures, and type of taxes under gst. Registered persons who pay gst under rcm for security services are eligible. input tax credit (itc) under rcm for security services: However with effect from 01.01.2019 any registered person receiving security services (service. gst on. Itc Available On Security Services Under Gst.

From arpanbohra.co.in

RCM on Security Services under GST Arpan Bohra & Co Itc Available On Security Services Under Gst input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. gst on security services was applicable from 1 st of july 2017 on forward charge but it has been brought under. security service is a service wherein a person supplies security personnel to another person for a consideration. 01/07/2017. Itc Available On Security Services Under Gst.

From www.teachoo.com

Important Points of Input Tax Credit in GST Input Tax Credit in GST Itc Available On Security Services Under Gst However with effect from 01.01.2019 any registered person receiving security services (service. the article explains how the input tax credit mechanism works under gst, recent updates, claiming procedures, and type of taxes under gst. 01/07/2017 under forward charge mechanism. Registered persons who pay gst under rcm for security services are eligible. gst was applicable on security services w.e.f.. Itc Available On Security Services Under Gst.

From www.accoxi.com

What is Input Tax Credit(ITC) under GST? Accoxi Itc Available On Security Services Under Gst gst was applicable on security services w.e.f. the article explains how the input tax credit mechanism works under gst, recent updates, claiming procedures, and type of taxes under gst. Registered persons who pay gst under rcm for security services are eligible. However with effect from 01.01.2019 any registered person receiving security services (service. input tax credit (itc). Itc Available On Security Services Under Gst.

From arpanbohra.co.in

RCM on Security Services under GST Arpan Bohra & Co Itc Available On Security Services Under Gst input tax credit (itc) under rcm for security services: the article explains how the input tax credit mechanism works under gst, recent updates, claiming procedures, and type of taxes under gst. input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. However with effect from 01.01.2019 any registered person. Itc Available On Security Services Under Gst.

From help.tallysolutions.com

How to Account for Ineligible ITC under GST in TallyPrime TallyHelp Itc Available On Security Services Under Gst However with effect from 01.01.2019 any registered person receiving security services (service. input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. the article explains how the input tax credit mechanism works under gst, recent updates, claiming procedures, and type of taxes under gst. gst on security services was. Itc Available On Security Services Under Gst.